Slowdown on the UK art market

[18 Jul 2023]Continuing our series reviewing the world’s major art marketplaces over the first half of this year and having already looked at the United States, France and Germany, Artprice by Artmarket turns its attention this week to the UK, the third largest art marketplace in the world. Like France and to a lesser extent America, the UK market has been much quieter than last year, although their H1 figures have just been substantially boosted by a superb result in London for a Gustav Klimt masterpiece.

With a total of $960 million dollars from the sale of approximately 2,700 works, the UK’s H1 2023 turnover is down 35% compared with the same period last year ($1.47 billion from 2,842 works). This is one of the sharpest contractions in the world: the American market shrank 26% (last year was an exceptional year and naturally difficult to repeat) and the French H1 total dropped 39% vs H1 2022.

Relativizing the losses…

By the end of H1 2022, the Western art market seemed to be back on a strong growth path driven by superb results in New York and London. The US market was up 42% and that of the United Kingdom market was up 26%. So the backslides of -26% and -35% this year are clearly relative. Nevertheless, the UK’s H1 total would have been down quite a lot more had it not been for the superb sales total of $241 million hammered by Sotheby’s at its Modern and Contemporary Art sales on 27 June.

Despite the postponement of auction sales in China (down 53% in the H1 last year) caused by an additional Covid-19 wave, global art auction turnover figures for the first semester of 2022 were exceptionally good. Artprice counted a record number of transactions (an absolute record of 326,000 lots sold in six months) and ranked this period as being the 5th best-ever H1 period in art auction history (+8.8% vs. H1 2021).

The contractions seen this year on most major market places are therefore relative to the exceptional results obtained last year, benefitting from an unprecedented post-covid energy (barring Cina).

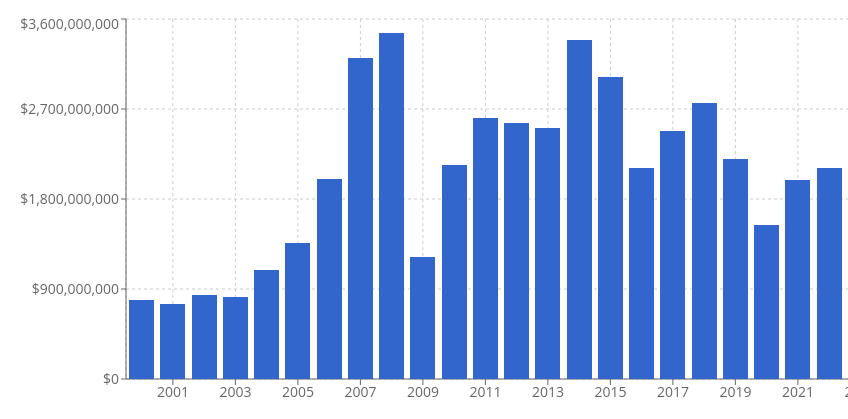

Annual evolution of the UK’s art auction (copyright artprice.com)

The drop in the UK’s art auction turnover this year owes nothing to a contraction in supply. Auction catalogs have been fueled by a good volume of works this year (around 64,000 in H1 2023 versus around 62,000 lots offered over the same period last year) and the number of successful transactions has remained roughly stable (only a slight decrease of 5%). The auction market has therefore not been side-stepped and the offer is still dense. The big difference versus the first half of 2022 is the drop in the number of transactions at the ultra-high end of the market.

As was the case with the New York sales, the London sales were generously fueled with absolutely exceptional works last year, with four of them exceeding $50 million in London during the first half of 2022. This year, no work had reached this price threshold in the UK before the end of June. It was only during the sale on June 27 that Sotheby’s hit the headlines by selling a masterpiece by Gustav Klimt for $108.39 million, setting a new auction record for an artwork sold at auction in Europe.

The four results above $50 million in H1 2022:

-

$79.3 million: The Empire of Lights (1961), René Magritte (Sotheby’s)

-

$56.8 million: The Foxes (1913), Franz Marc (Christie’s)

-

$52.5 million: Study for Portrait of Lucian Freud (1964), Francis BACON (Sotheby’s)

-

$51.2 million: Triptych 1986-7 (1986-1987), Francis BACON (Christie’s)

UK: evolution of the number of auction results above $50 million since 2000 (copyright artprice.com)

Despite the superb result of more than $100 million obtained for Klimt’s Lady with a fan, London’s major auctioneers are very unlikely to offset the shortfall versus 2022 over the rest of the year. For example, Christie’s would have to hammer $600 million during H2 which seems unlikely after the $293.5 million obtained in H1. The leading UK auctioneer generated $893.7 million in London last year. But, who knows? several unexpected masterpieces by Magritte, Francis Bacon, Claude Monet or even another exceptional Klimt work could shake up the 2023 fall sales.

The three most profitable artists in the UK market in 2023 (copyright artprice.com)

0

0