Collecting and Investing in Art

The collection of artworks requires a general understanding of the market, and a certain knowledge of the nature of its supply and demand. First, you have to know where and when to buy, of course, but then you have to keep track of price changes, if only for insurance purposes. Like it or not, collecting art is always a form of investment. Fortunately, it’s a very lucrative investment.

Since 2000, the Price Index for the global Art Market as a whole – calculated by Artprice on the basis of global auction results – has grown by 36%. In comparison, the S&P 500 has gained 86% over the same period, the FTSE 100 is up 2% and France’s CAC 40 is down -19%. The Art Market – taken as a whole, and including all periods and price ranges – is therefore a competitive form of investment and an alternative to traditional financial assets. Of course, we have to closely monitor the volatility of artists’ prices and bear in mind the specificities of the Art Market: factors like the market liquidity of works, transaction fees, insurance costs, etc.

Price changes

The appeal of Art as an investment stems from the exponential value increases that affect certain works and, in certain cases, the media coverage they attract. 2017 saw plenty of examples of exceptional capital gains.

Top 10 stocks recorded in 2017 (selection)

| Auction 1 | Auction 2 | ||||

|---|---|---|---|---|---|

| Artist | Artwork | Price | Sale | Price | Sale |

| Jean-Michel BASQUIAT (1960-1988) | Jim Crow (1986) | $136,367 | 3 Dec. 1992 Christie’s London | $17,680,936 | 20 Oct. 2017 Christie’s Paris |

| QI Baishi (1864-1957) | Buddhahandzitronen und Pfirsiche | $6,304 | 19 May. 2001 Nagel Stuttgart | $445,603 | 16 Jun. 2017 Nagel Stuttgart |

| Richard PRINCE (b. 1949) | All I’ve Heard (1988) | $38,125 | 18 May. 2000 Sotheby’s New York | $2,532,500 | 16 Nov. 2017 Christie’s New York |

| Keith HARING (1958-1990) | Untitled (1985) | $4,800 | 29 Sep. 1993 Sotheby’s New York | $316,680 | 9 Mar. 2017 Sotheby’s London |

| Lucio FONTANA (1899-1968) | Concetto spaziale, Attese (1962-1963) | $84,630 | 24 Apr. 1997 Bukowskis Stockholm | $4,957,024 | 20 Oct. 2017 Christie’s Paris |

| Helene FUNKE (1869-1957) | Still life with pears and grapes on blue cloth | $680 | 22 Jun. 1995 Christie’s London | $38,150 | 21 Nov. 2017 Dorotheum Vienna |

| HUANG Binhong (1865-1955) | Mountain Studios in Solitude (1925) | $12,174 | 28 Apr. 1997 Sotheby’s Hong Kong | $658,023 | 2 Oct. 2017 Sotheby’s Hong Kong |

| ZHANG Daqian (1899-1983) | Autumn Mountains in Verdant Mist (1968) | $59,802 | 1 May. 2000 Sotheby’s Hong Kong | $2,778,034 | 2 Oct. 2017 Sotheby’s Hong Kong |

| XU Beihong (1895-1953) | Galloping Horse (1951) | $31,154 | 26 Apr. 1999 Sotheby’s Hong Kong | $1,124,837 | 4 Apr. 2017 Sotheby’s Hong Kong |

| Philip GUSTON (1913-1980) | Summer Kitchen Still Life (1978-1979) | $187,000 | 13 Nov. 1991 Christie’s New York | $6,612,500 | 15 Nov. 2017 Christie’s New York |

| © Artprice.com | |||||

From a financial point of view, the evolution of Jean-Michel BASQUIAT’s prices represents a perfect illustration: since his death in 1988, the price of his paintings and drawings has risen so quickly that lots of museums missed the opportunity to acquire his works at reasonable prices. This year again, his painting Jim Crow (1986) provided an excellent example of the fascinating progression of his prices: its value multiplied by a factor of 130 between 1992 and 2017.

Similarly, the sale of Richard PRINCE’s All I’ve Heard (1988) shows how a collector can take advantage of the emergence of a Contemporary artist by buying his works at the right time and holding on to them for a sufficiently long period.

Remember, there is no minimum investment. By paying $680 for a small still-life by Helene FUNKE at Christie’s in London in 1995, a collector generated a spectacular return without having to raise a large initial sum. Twenty-two years later he sold the work in Vienna for over $38,000 (a percentage return of 5,510%).

The financial attractiveness of art (and particularly of Contemporary art) goes hand in hand with an inevitable financial risk. The value of many works sold in 2017 has greatly diminished since their last appearance in the auction room. Among the examples of spectacular falls, the cases of two American artists, Jacob KASSAY and Parker ITO, highlight the risks of investing in young fashionable signatures. Their works were much in demand between 2011 and 2014, but their prices have almost divided by ten since then.

Top 5 capital losses in 2017 (selection)

| Auction 1 | Auction 2 | ||||

|---|---|---|---|---|---|

| Artist | Artwork | Price | Sale | Price | Sale |

| Jeanne DAVIES (b. 1936) | Peacable Kingdom | $12,000 | 14 Jun. 2007 Sotheby’s New York | $625 | 14 Jun. 2017 Christie’s New York |

| Antonio JACOBSEN (1850-1921) | Westmeath (1896) | $23,000 | 19 Aug. 2001 Northeast Auctions Portsmouth | $1,250 | 20 Sep. 2017 Christie’s New York |

| ZENG Hao (b. 1963) | 5:00 Am 3 April 1999 (1999年4月3日上午5时) | $100,958 | 25 May. 2008 Christie’s Hong Kong | $9,653 | 3 Apr. 2017 Sotheby’s Hong Kong |

| Jacob KASSAY (b. 1984) | Untitled (2010) | $104,500 | 8 Nov. 2011 Phillips de Pury New York | $10,000 | 28 Sep. 2017 Christie’s New York |

| Parker ITO (b. 1986) | Inkjet Painting #6 (2013) | $46,895 | 1 Jul. 2014 Sotheby’s London | $4,800 | 1 Oct. 2017 Sotheby’s Hong Kong |

| Jeff KOONS (b. 1955) | Jim Beam – Observation Car (1986) | $1,625,000 | 16 May. 2013 Phillips New York | $665,336 | 7 Mar. 2017 Christie’s London |

| © Artprice.com | |||||

The year’s most surprising depreciation was undoubtedly the price hammered at the resale of Jeff KOONS’ Jim Beam – Observation Car (1986), of which there exist three copies and one artist’s proof. The value of the proof lost almost a million dollars (-59%) over five years!

Holding periods

One of the most criticised aspects of the Art Market in recent years has been the increase in repeat resales, especially on the most fashionable signatures. During the last 12 months, certain works were presented several times for sale at auctions in order to profit from relatively sudden value accretions.

Top 10 resales in 2017 (selection)

| Auction 1 | Auction 2 | ||||

|---|---|---|---|---|---|

| Artist | Artwork | Price | Sale | Price | Sale |

| Mauro MALANG SANTOS (1928-2017) | Untitled (The Jubilee Quadriptych) (1994-1999) | $76,163 | 23 Sep. 2017 Salcedo Auctions Makati | $97,621 | 2 Dec. 2017 Leon Gallery Makati |

| Bernard BUFFET (1928-1999) | La Seine et la Tour Saint-Jacques (1960) | $177,470 | 28 Jun. 2017 Christie’s London | $169,358 | 20 Oct. 2017 Christie’s Paris |

| Bernard AUBERTIN (1934-2015) | Tableau clous (Nails painting)(1968) | $13,308 | 13 Jun. 2017 Il Ponte Casa d’Aste Milan | $27,500 | 16 Nov. 2017 Christie’s New York |

| Etienne JEAURAT (1699-1789) | The Daughters of Cecrops Discovering Erichthonius | $27,726 | 11 Jun. 2017 Rouillac Vendôme | $33,575 | 7 Dec. 2017 Sotheby’s London |

| François-Xavier LALANNE (1927-2008) | Oiseau bleu (Blue Bird) (1975) | $1,295 | 25 May. 2017 Sotheby’s London | $2,500 | 13 Nov. 2017 Sotheby’s Dubai |

| Matias SPESCHA (1925-2008) | Ohne Titel (1969) | $5,238 | 12 May. 2017 Dobiaschofsky Auktionen Bern | $8,863 | 5 Dec. 2017 Sotheby’s Zurich |

| Laxman SHRESHTHA (b. 1939) | Untitled (1994) | $2,470 | 6 Apr. 2017 Freeman Fine Arts Philadephia, PA | $4,141 | 25 Oct. 2017 Sotheby’s London |

| Jean DUBUFFET (1901-1985) | Palmiers aux bédouins (Palm Trees with Bedouins) (1948) | $83,567 | 23 Mar. 2017 Sotheby’s Paris | $137,500 | 13 Nov. 2017 Sotheby’s Dubao |

| MAN RAY (1890-1976) | Untitled (1958) | $16,250 | 17 Mar. 2017 Heritage Auctions Dallas, TX | $29,146 | 30 Jun. 2017 Christie’s London |

| Haim STEINBACH (1944) | Pops (2006) | $27,389 | 10 Mar. 2017 Phillips London | $65,658 | 05 Oct. 2017 Phillips London |

| © Artprice.com | |||||

The skill with which these operations are conducted suggests that some collectors might be motivated by financial gain. As in other efficient markets, today’s Art Market includes players seeking to take advantage of its ‘asymmetries’. François-Xavier LALANNE’s Oiseau bleu (Blue Bird) (1975) and Jean DUBUFFET’s Palmiers aux bédouins (Palm Trees with Bedouins) (1948) were acquired at the beginning of the year at Sotheby’s in London and Paris and then resold on 13 November 2017 in Dubai… a striking example of some of the carefully thought-out strategies that are today being used in the Art Market.

Of course, shorter holding times do not guarantee easy winnings, and, in any case, quick profits are not always the motive for resale. Liquidity requirements have long been recognised as a common motive for rapid resales, with certain collectors reselling works they have just acquired, even if it means incurring heavy losses in addition to transaction costs.

Expected returns

The analysis of a large number of lots bought and subsequently re-sold at auction (repeat sales) offers a much more sober vision of the returns that can be expected on the Art Market. Artprice therefore conducted an objective analysis of the price evolution of 4,100 lots sold in 2017, for which a previous public sale could be clearly identified and confirmed by an auction house. The average annual return for this sample is + 5.7%.

The price segmentation of this sample reveals that the expected returns vary according to the initial investment. Up to a certain threshold, the profitability increases proportionally to the purchase price of the works. However, above a million dollars, the returns appear to contract somewhat.

Financial performances by price range of the artworks sold in 2017

| Purchase price | Annual yield | Number of years between the two sales |

|---|---|---|

| $10,000 – 50,000 | 5.5% | 11.3 |

| $50,000 – 200,000 | 7.1% | 10.1 |

| $200,000 – 1 million | 8.3% | 9.4 |

| > $1 million | 6.6% | 8.6 |

| © Artprice.com | ||

Investments between $200,000 and $1 million show the best results. However, none of the best progressions recorded in 2017, nor any of the heaviest losses (see tables above), correspond to this price range. In short, by paying between $200,000 and $1 million you guarantee a certain quality that reduces the risk of a sharp decrease in value, while maintaining a significant growth potential. These lots therefore constitute the most profitable price segment of the Art Market.

Artprice100© – “The Wolves of Wall Street at the gates of the Art Market”

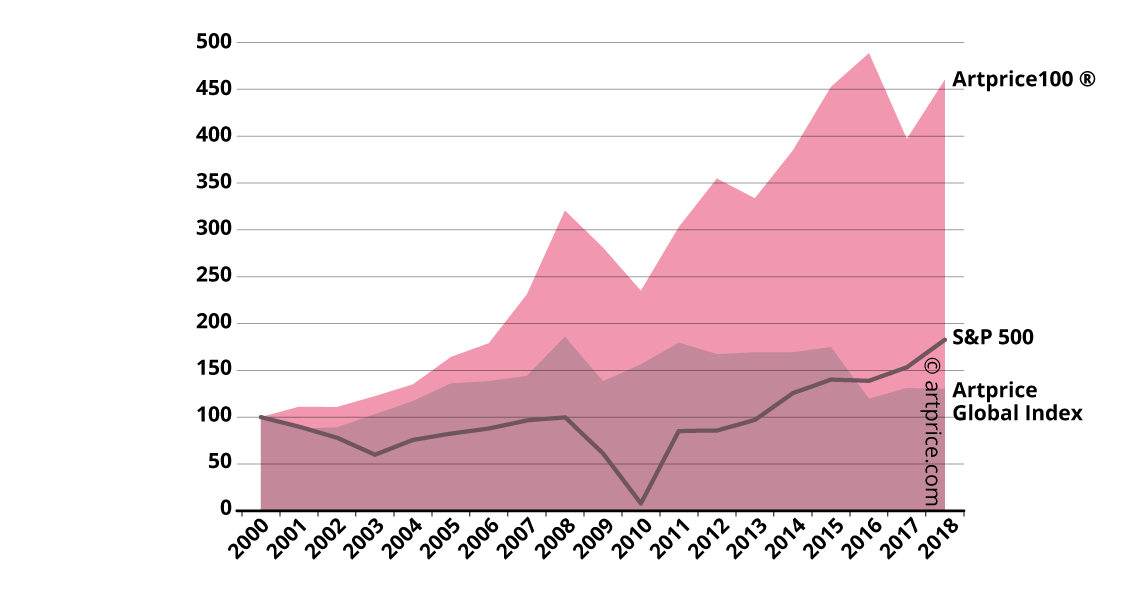

Artprice’s Global Index® shows an average value increase for artworks of +30% since the index was started 20 years ago. Although this is an appreciable performance, particularly at a time when central banks’ interest rates are close to zero in the United States (FED) and negative in Europe (ECB), if we focus uniquely on the most stable segment of the market, we find a much more impressive value accretion.

Thierry Ehrmann, founder and CEO of Artprice, said “Artprice’s econometrics department has created a new index that ignores the most volatile artists (those most subject to the price impact of fashion and speculation) and focuses exclusively on the art market’s “blue-chip” artists. This new index, Artprice100®, shows that art is an extremely competitive financial investment over the longer term.”

Artprice’s new Artprice100® scientific index is subject to IPR protection and represents a major new weapon in Artprice’s commercial arsenal as World Leader in Art Market Information.

PRINCIPLE

The objective of Artprice’s new Artprice100® index is to monitor and quantify the art market’s value accretion by focusing on its most stable elements. This new scientific index is a new tool in Artprice’s panoply of proprietary decision-support tools. In effect, the Artprice100® index represents an unavoidable new benchmark in a financial world constantly searching for new investment opportunities in efficient markets.

The creation of the Artprice100® index is a response to a recurring demand from Artprice’s financial and banking institution customers, particularly in the Private Banking segment, who need a reliable and durable benchmark that does not require specialist knowledge of the Art Market from its user.

With the Artprice100®, the Art Market – universally considered an alternative to traditional financial investments – now has a benchmark comparable to the world’s major stock indices like the S&P 500, the FTSE 100, the CAC 40, the DAX and the NIKKEI 225. It is composed using the same general principles for the construction of these indices: it focuses on the Art Market’s fundamental artists and takes into account their relative weight and importance.

COMPOSITION

The composition of the Artprice100® is adjusted by a scientific committee every 1st January to reflect the evolution of the Art Market. The index essentially identifies the 100 top-performing artists at auction over the previous five years who satisfy a key liquidity criterion (at least ten works of comparable quality sold each year). The weight of each artist is proportional to his/her annual auction turnover over the relevant period.

Thus, starting from 1 January 2000 – the Artprice100®’s reference year – an investment is made on the 100 artists whose auction results are the most regular (constant) and the highest (in turnover terms) during the previous five years (i.e. 1995, 1996, 1997, 1998 and 1999). The relative weight of each of the 100 artists is detailed in Appendix 1.

The composition of the index does not change during the year. Therefore, the overall value of the Artprice100® evolves according to the individual average performances of each artist in the portfolio, adjusted according to his or her weight within the portfolio.

FINANCIAL PERFORMANCES

In 2000, the value of the Artprice100® increased by 10.9%. Thus, for an initial investment of $100, the value of this portfolio already reached $110.9 by the end of 2000.

The contribution of each artist to this result provides additional information. For example, in 2000, the artist Pablo Picasso had a 16% weighting in the portfolio. During that year, his auction performance contracted by 9%. Therefore, the initial $16 invested in Pablo Picasso (16% of $100) was valued, at 31 December 2000, at $14.6.

Fortunately, the portfolio’s diversification helped offset Pablo Picasso’s negative performance in 2000. So, for example, that year saw strong positive performances for Robert Rauschenberg (+59%), Antoni Tapies (+48%), René Magritte (+18%), allowing the Artprice100® index to post a quite remarkable performance for the portfolio as a whole.

Over the long term, the performance of the Artprice100® largely exceeds that of Artprice’s Global Index and of the US stock market, as represented by the S&P 500.

The Artprice100® index – Base 100 at 1 January 2000

INDIVIDUAL PERFORMANCES

The Artprice100® index provides essential information since its very composition reflects the progressive evolution of the Art market. The artists included each year in the Top 100 are the market’s most important artists, weighted for their average performances over the previous five years.

This purely objective criterion allows identification of the most stable segment of the Art Market with a built-in evolution mechanism (annual adjustment). In fact, the new index relies on a huge mass of market information (Artprice’s Big Data) and eliminates possible blind spots that might escape the Index’s Scientific Council by analysing repeat sales and auction results from all over the planet. With its intranet connecting it with more than 6,300 Auction Houses, Artprice is the only organization in the world that can process this data and produce an index based on a highly complex series of calculations.

The composition of the Artprice100® for the years 2000 and 2017 is provided in the Appendices. From 2016 to 2017, four artists joined the index and four left (as with stock indices):

Joiners (incoming): Agnes Martin, Francis Picabia, Barbara Hepworth, Michelangelo Pistoletto

Leavers (outgoing): Giorgio De Chirico, Alexej von Jawlensky, Paul Klee, Cindy Sherman

This gradual transformation of the 100 artists within the Artprice100® is striking over the long term. For example, in 2000, there was only one Chinese artist in this list (Zhang Daqian) compared with 18 in 2017.

CONCLUSION

Over 18 years, the Artprice100® grew by 360%, generating an average annual return of 8.9%. This revolutionary approach to investment in the Art Market allows the financial and investment community to apprehend the Art Market via the art of “index management”, a possibility that was hitherto non-existent. This average annual return of 8.9% represents the profitability of the art market’s most stable segment.

It proves once again that a relatively well-diversified art portfolio, constructed on the basis of a simple and non-aggressive acquisition strategy, has a genuine economic raison d’être, quite apart from the non-pecuniary benefits of collecting art.

Over the last 20 years, the art market has massively increased in liquidity and has grown to now be widely appreciated as a genuinely efficient market to which Artprice – as world leader – has substantially contributed.

Via its contacts in the financial sphere, Artprice aims to get its Artprice100® index and derivative products rapidly included in the standard financial newsflow packages used in trading rooms around the world.

Appendix 1 – Composition of the Artprice100® in 2000

Rank – Artist – Weight

1 – Pablo PICASSO – 16.1%

2 – Claude MONET – 7.8%

3 – Paul CÉZANNE – 5.3%

4 – Pierre-Auguste RENOIR – 4.7%

5 – Edgar DEGAS – 3.9%

6 – Henri MATISSE – 2.9%

7 – Marc CHAGALL – 2.8%

8 – Amedeo MODIGLIANI – 2.8%

9 – Andy WARHOL – 2.2%

10 – Joan MIRO – 2.0%

11 – Camille PISSARRO – 1.7%

12 – Fernand LÉGER – 1.7%

13 – René MAGRITTE – 1.6%

14 – Henry MOORE – 1.4%

15 – Alberto GIACOMETTI – 1.3%

16 – Auguste RODIN – 1.2%

17 – Georges BRAQUE – 1.1%

18 – Pierre BONNARD – 1.1%

19 – Jean DUBUFFET – 1.1%

20 – Kees VAN DONGEN – 1.0%

21 – Paul GAUGUIN – 1.0%

22 – Jasper JOHNS – 1.0%

23 – Wassily KANDINSKY – 1.0%

24 – Paul KLEE – 0.9%

25 – Alexander CALDER – 0.9%

26 – Alfred James MUNNINGS – 0.9%

27 – Alfred SISLEY – 0.9%

28 – Maurice DE VLAMINCK – 0.9%

29 – Gerhard RICHTER – 0.8%

30 – Édouard VUILLARD – 0.8%

31 – Willem DE KOONING – 0.8%

32 – Jean-Michel BASQUIAT – 0.8%

33 – Emil NOLDE – 0.8%

34 – Roy LICHTENSTEIN – 0.8%

35 – Giorgio MORANDI – 0.8%

36 – Egon SCHIELE – 0.7%

37 – Pieter II BRUEGHEL – 0.7%

38 – Salvador DALI – 0.7%

39 – Lucio FONTANA – 0.7%

40 – Juan GRIS – 0.6%

41 – Giorgio DE CHIRICO – 0.6%

42 – Ernst Ludwig KIRCHNER – 0.6%

43 – Maurice UTRILLO – 0.6%

44 – Raoul DUFY – 0.6%

45 – Eugène BOUDIN – 0.6%

46 – Camille Jean-Baptiste COROT – 0.5%

47 – Paul SIGNAC – 0.5%

48 – Edvard MUNCH – 0.5%

49 – Francis BACON – 0.5%

50 – Rufino TAMAYO – 0.5%

51 – Alexej VON JAWLENSKY – 0.5%

52 – Cy TWOMBLY – 0.4%

53 – Wifredo LAM – 0.4%

54 – Diego GIACOMETTI – 0.4%

55 – Laurence Stephen LOWRY – 0.4%

56 – Piet MONDRIAAN – 0.4%

57 – Marino MARINI – 0.4%

58 – Jack Butler YEATS – 0.4%

59 – Max ERNST – 0.4%

60 – Odilon REDON – 0.4%

61 – Albert MARQUET – 0.4%

62 – Georges ROUAULT – 0.4%

63 – Franz MARC – 0.4%

64 – Sam FRANCIS – 0.3%

65 – Fernando BOTERO – 0.3%

66 – Robert RAUSCHENBERG – 0.3%

67 – Richard DIEBENKORN – 0.3%

68 – Hermann Max PECHSTEIN – 0.3%

69 – Bernard BUFFET – 0.3%

70 – Henri-Théodore FANTIN-LATOUR – 0.3%

71 – Diego RIVERA – 0.3%

72 – Roberto MATTA – 0.3%

73 – Karel APPEL – 0.3%

74 – Georg BASELITZ – 0.3%

75 – Frank STELLA – 0.3%

76 – Serge POLIAKOFF – 0.3%

77 – Moïse KISLING – 0.3%

78 – MAN RAY – 0.3%

79 – Yves KLEIN – 0.3%

80 – ZHANG Daqian – 0.3%

81 – Asger JORN – 0.3%

82 – Gino SEVERINI – 0.3%

83 – John LAVERY – 0.3%

84 – Anders Leonard ZORN – 0.2%

85 – Aristide MAILLOL – 0.2%

86 – Lyonel FEININGER – 0.2%

87 – Erich HECKEL – 0.2%

88 – Max BECKMANN – 0.2%

89 – Sigmar POLKE – 0.2%

90 – Marie LAURENCIN – 0.2%

91 – Henri MARTIN – 0.2%

92 – Henri LE SIDANER – 0.2%

93 – Otto DIX – 0.2%

94 – Louis VALTAT – 0.2%

95 – Gustave LOISEAU – 0.2%

96 – Antoni TAPIES – 0.2%

97 – Jean FAUTRIER – 0.2%

98 – Adrien Jean LE MAYEUR DE MERPRES – 0.2%

99 – Massimo CAMPIGLI – 0.2%

100 – David HOCKNEY – 0.2%

Appendix 2 – Composition of the Artprice100® in 2017

Rank – Artist – Weight

1 – Pablo PICASSO – 6.8%

2 – Andy WARHOL – 6.8%

3 – ZHANG Daqian – 4.4%

4 – QI Baishi – 3.8%

5 – Gerhard RICHTER – 3.7%

6 – Claude MONET – 3.4%

7 – Francis BACON – 3.3%

8 – Jean-Michel BASQUIAT – 2.9%

9 – Roy LICHTENSTEIN – 2.2%

10 – Alberto GIACOMETTI – 2.1%

11 – FU Baoshi – 2.0%

12 – Cy TWOMBLY – 1.9%

13 – ZAO Wou-Ki – 1.8%

14 – Amedeo MODIGLIANI – 1.8%

15 – XU Beihong – 1.8%

16 – Alexander CALDER – 1.8%

17 – LI Keran – 1.8%

18 – Lucio FONTANA – 1.7%

19 – Joan MIRO – 1.7%

20 – WU Guanzhong – 1.7%

21 – Willem DE KOONING – 1.6%

22 – HUANG Zhou – 1.5%

23 – Marc CHAGALL – 1.4%

24 – HUANG Binhong – 1.3%

25 – LU Yanshao – 1.3%

26 – Jeff KOONS – 1.3%

27 – Christopher WOOL – 1.2%

28 – LIN Fengmian – 1.0%

29 – CHU Teh-Chun – 1.0%

30 – Yves KLEIN – 0.9%

31 – Henri MATISSE – 0.9%

32 – Fernand LÉGER – 0.9%

33 – René MAGRITTE – 0.9%

34 – Henry MOORE – 0.9%

35 – Jean DUBUFFET – 0.9%

36 – Wassily KANDINSKY – 0.8%

37 – PAN Tianshou – 0.8%

38 – Edvard MUNCH – 0.8%

39 – Pierre-Auguste RENOIR – 0.8%

40 – Paul CÉZANNE – 0.7%

41 – SAN Yu – 0.7%

42 – Yayoi KUSAMA – 0.7%

43 – Peter DOIG – 0.6%

44 – PU Ru – 0.6%

45 – Edgar DEGAS – 0.6%

46 – Auguste RODIN – 0.6%

47 – Richard PRINCE – 0.6%

48 – Joan MITCHELL – 0.6%

49 – Sigmar POLKE – 0.5%

50 – Camille PISSARRO – 0.5%

51 – Paul GAUGUIN – 0.5%

52 – Salvador DALI – 0.5%

53 – Martin KIPPENBERGER – 0.4%

54 – Ed RUSCHA – 0.4%

55 – DONG Qichang – 0.4%

56 – Paul SIGNAC – 0.4%

57 – Piet MONDRIAAN – 0.4%

58 – Egon SCHIELE – 0.4%

59 – Alberto BURRI – 0.4%

60 – Richard DIEBENKORN – 0.4%

61 – Georges BRAQUE – 0.4%

62 – Juan GRIS – 0.4%

63 – WEN Zhengming – 0.4%

64 – Damien HIRST – 0.4%

65 – Pieter II BRUEGHEL – 0.4%

66 – Donald JUDD – 0.3%

67 – Louise BOURGEOIS – 0.3%

68 – Keith HARING – 0.3%

69 – Piero MANZONI – 0.3%

70 – Alfred SISLEY – 0.3%

71 – David HOCKNEY – 0.3%

72 – Max ERNST – 0.3%

73 – CHEN Yifei – 0.3%

74 – Ernst Ludwig KIRCHNER – 0.3%

75 – Frank STELLA – 0.3%

76 – Sam FRANCIS – 0.3%

77 – Pierre BONNARD – 0.3%

78 – Alighiero BOETTI – 0.3%

79 – Kees VAN DONGEN – 0.3%

80 – Jasper JOHNS – 0.3%

81 – Pierre SOULAGES – 0.3%

82 – Bernard BUFFET – 0.3%

83 – Fernando BOTERO – 0.3%

84 – Laurence Stephen LOWRY – 0.3%

85 – Agnes MARTIN – 0.3%

86 – Enrico CASTELLANI – 0.3%

87 – Robert RAUSCHENBERG – 0.3%

88 – Morton Wayne THIEBAUD – 0.3%

89 – Nicolas DE STAËL – 0.3%

90 – Francis PICABIA – 0.2%

91 – Barbara HEPWORTH – 0.2%

92 – Anselm KIEFER – 0.2%

93 – GUAN Liang – 0.2%

94 – YU Fei’an – 0.2%

95 – Emil NOLDE – 0.2%

96 – Maurice DE VLAMINCK – 0.2%

97 – Georg BASELITZ – 0.2%

98 – Tom WESSELMANN – 0.2%

99 – Anish KAPOOR – 0.2%

100 – Michelangelo PISTOLETTO – 0.2%

0

0